Choosing a contractor who understands the insurance process can save you time and frustration, you will be required to sign a “Work Authorization” for them to begin work. Always remember to read before you sign, there are other types of forms you will want to avoid!

There are insurance Preferred/Qualified vendors familiar with communicating a written itemized estimate and providing timely service to brining the insured back to whole.

Since each contractor is looking at the same scope of work, the pricing should also be the same between these vendors, it boils down to who you feel comfortable with completing the task.

- An agreement will be established between you and the vendor on a printed form. This agreement should explain the expectations of each party.

- The carrier usually does not dictate which vendor to use.

- If your roof qualifies for the coverage your settlement will include an estimate for replacement or repair.

- The roofer usually follows the estimate exactly as it addresses the damage.

- Any upgrades you choose to make will be an additional expense not covered in the settlement amount. (The Insured may choose better ventilation, higher quality shingle and/or lead plumbing jacks that last 30-Years instead of flashed plumbing jacks that wear out in 12-Years.)

- If a supplement is required a “Preferred/Qualified Roofing Vendor” knows how to document and file the request on your behalf.

See #9 below:

WORKING WITH PREFERED/QUALIFIED VENDORS:

The majority of vendors are independent and do not work directly for the insurance carrier. Preferred/Qualified vendors are a curtesy recommendation.

Understanding the contracts presented by the vendors:

- Review and read all paperwork before signing, the carrier and/or adjuster can provide further insight if needed.

- Avoid signing agreements that give the contractor the right to act on your behalf.

- Protect yourself; Do Not Sign any contracts that use the “Assignment of Benefits” language without fully understanding what an AOB is. Read what the Florida CFO shares AOB info.

- By signing an AOB you surrender your rights to the vendor. They can then receive a check directly from the carrier without performing any work, they can also hold your job hostage demanding more monies above the actual scope of work. This can snowball into a real tangled mess leaving the insured to pay out of pocket.

- What is a “Work Authorization or Service Authorization”: This is required to begin work, this is a normal business practice so that all parties are in agreement to the terms of service offered. Typically, this agreement gives your vendor permission to provide services immediately and continue the project to completion following collaboration through the Adjuster or insurance carrier Desk Adjuster.

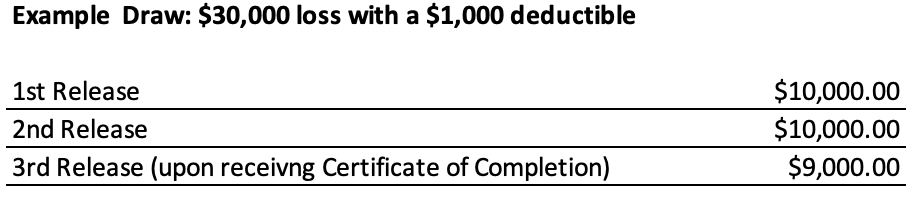

- What is a “Direction to Pay”: This gives authorization for the carrier to pay the contractor directly following completion of the work. Many carriers stipulate specific requirements before submitting payment to the vendor such as “Certificate of Completion”.

Example: Sample Contract Wording: To start our emergency and restoration service, you must sign the “Service Authorization Form.” This allows mitigation/restoration company to act immediately. We do not know your insurance coverage; therefore, we can’t know exactly what your insurance will cover. It is important to understand you are financially responsible for our services. Your deductible is payable before we start work. If for any reason insurance coverage cannot be verified at the time of our emergency service, an additional deposit may be required.

The following information may or may not apply to this wind/hail loss.

WATER MITIGATION: Depending on the type of water damage; It is important to dry out your property as soon as possible, this may take 3 to 5 days by an IICRC, WRT Certified Technician.

- There is a science to drying out different types of material, some items will not be salvageable.

- Long term health issues can be diverted by having your property professionally dried out to prevent Mold and Mildew issues that can ultimately affect your respiratory system or more.

- What is a “Peer Review”: Sometimes the carrier will request a Peer Review; This process is when another company for example: will duplicate the Water Mitigation process through measurements and dry out log sheets to determine the appropriate equipment was used in the drying process of your property.

RESTORATION / ROOFING CONTRACTOR: are (Licensed Contractor/Roofing Contractor) a specialist in their field; in addition to knowing the requirements to conduct the appropriate repair they also understand the insurance format requirements such as documenting “Scope of Work” and “Line Items”.

- They will discuss the “Scope of Work” with the adjuster and provide a “Line Item” estimate to the carrier reflecting the removal and replacement to effectuate the damaged area to pre-loss conditions

- Please understand – Not every contractor is familiar with the insurance environment as it relates to your coverage!

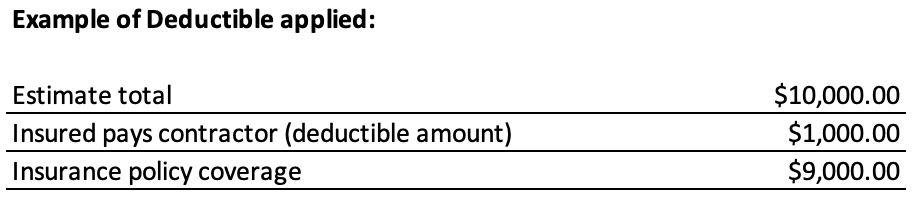

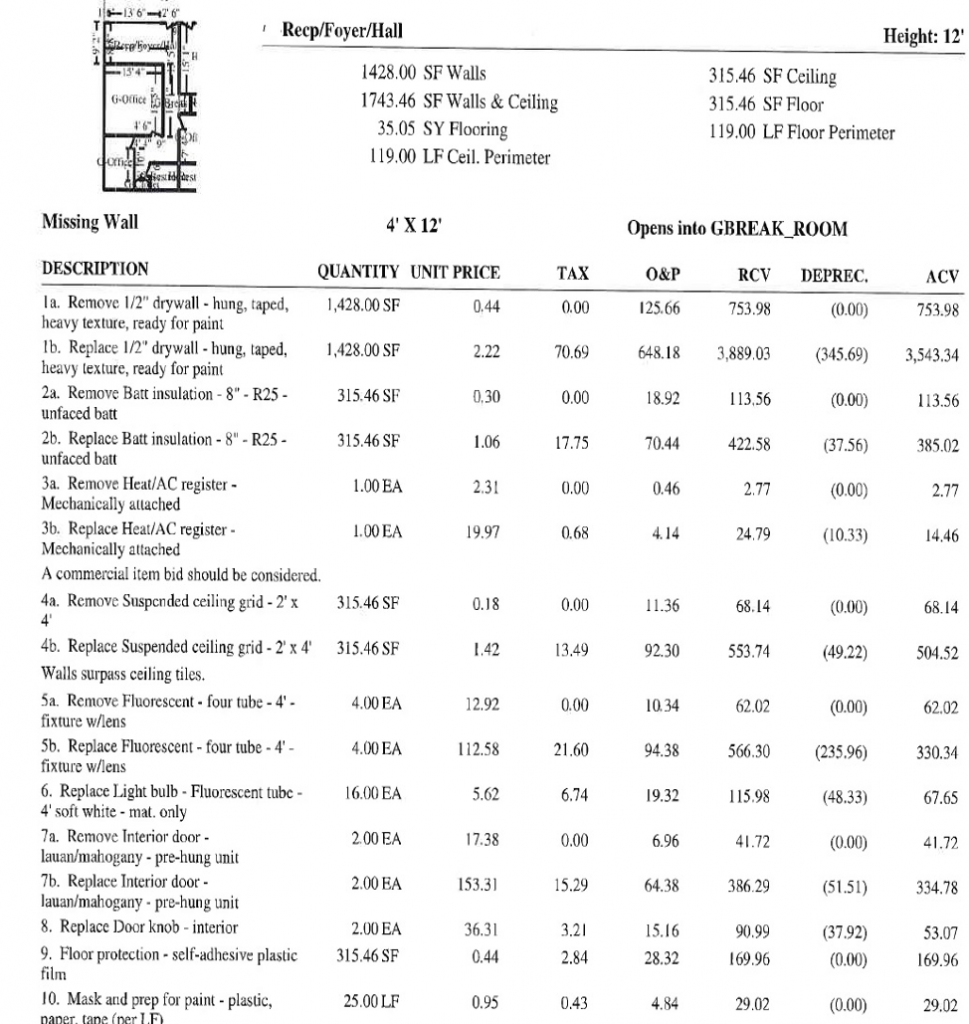

- Estimates recognized in this industry are based on-line items; utilizing linear feet, square feet, and item count and/or squares. These are similar to procedure codes in health insurance.

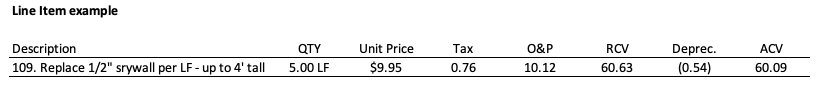

- What is a Line Item? A specific price applied to a unit of measurement. It is similar to Procedure Codes in the US Health Care System.

- Written Estimate: A summary of each effected room in the dwelling and/or Other Structure-Fence, Workshop, Shed, Barn, etc., will be grouped separately; each reflecting a unit of measurement representing labor and materials as it applies to the repair or replacement of a covered item, which is summarized in a “Line Item”; additional Line Items may include service hours and dry-out equipment. Estimates are created from 3rd party software such as Xactimate, Symbility, Simsol, etc…

Important: The initial estimate can only be written for damages seen (based on your policy contract); if there are additional damages discovered or components required during the repair or replacement process a supplement can be applied for by the vendor/contractor through the Desk Adjuster for additional coverage. Insurance vendors know how this process works.

Excerpt from Estimate

- Any upgrades and improvements will be at an additional cost to the insured and worked out between you and the contractor.

- SUPPLEMENT: Request for additional funds needed that relate to the loss. The restoration company knows how to document and file for a supplement if needed, saving you tremendous time in the process!

Important: If the estimate received from the contractor is higher than the settlement amount, you should notify your carrier before work begins. The carrier must have the opportunity to review and/or view the additional proposed damages.