Report your cause of loss; Be sure to provide the best phone number/’s and email address. Share Date of Loss and exactly what happened to the best of your knowledge. This will help the carrier to determine potential service vendors needed to effectuate your claim.

Note: There is usually a limit to mold coverage (In Florida it is $10,000) The adjuster/desk adjuster at the carrier will provide the best direction for corrective action for remediation protocol to prevent the insured from being excessively charged by one vendor for services not needed.

The adjuster will contact you within 24 hours of receiving the assignment. Please share any current receipts, invoices, or paperwork you have received as the result of this event.

The following may be directed by the field adjuster or the carrier desk adjuster: In Florida, many of the insurance carriers prefer the adjuster not refer contractors.

- Contractor – Board-Ups (cover & tarp openings in a structure)

- Contractor – Restoration, to rebuild the structure.

- Mitigation company – Evacuate smoke and/or remove water.

- Mitigation and/or Restoration company – Clean and inventory contents damaged by fire, smoke or water. This allows your contents coverage to work for you by minimizing your cost of content replacement.

Most insurance carriers use qualified vendors; however, they allow the insured to choose vendors in addition to the preferred vendor’s list.

Your specific needs may vary regarding the need for Water Mitigation and/or Restoration by a Certified mold specialist. The effects of hidden water damage can have long term ramifications, equally; not all water damage is detrimental to your surfaces.

- A vendor may be dispatched by the carrier or the insured can contact a local qualified mitigation company. In either case: depending on the level of damage immediate service may be required.

- Based on the height of the water, damaged contents and building material may need to be removed to include (cutting a flood-cut up & across the wall to remove damaged drywall).

RESTORATION CONTRACTOR-

- A restoration contractor may be dispatched by the carrier or the insured can contact a local restoration company. Depending on the level of damage immediate service may be required.

Make sure the contractor is in communication with the Desk Adjuster and/or Field Adjuster.

(See Choosing a Qualified Vendor below)

These inspections vary per claim, realizing there is limited coverage for mold; the goal is to mitigate within the constraints of coverage. For example, the affected area is less than 10 Sq Ft; wearing the proper protective gear the area can be remediated by a Mitigation or Restoration Company.

- Mold Certified Water Mitigation company

- Mold Certified Restoration Company

The following inspections may be required based on the direction of Water Mitigation or Restoration Companies’ inspection.

- HYGIENIST – A specialist with a Scientific perspective in taking air and surface samples to be analyzed in a laboratory.

- MOLD PROTOCOL – (Process) A separate vendor will establish guidelines and equipment needed to mitigate the mold. (This aids in a transparent cleaning process to prevent excess billing for unnecessary work).

WATER MITIGATION AND/OR MOLD REMEDIATION SERVICES:

See section #7 Choosing a Mold Qualified Vendor

Important: The carrier has to be allowed the “right to inspect” damage for cause and origin. A delay of an immediate inspection may jeopardize your coverage.

- The insured (per policy) is required to protect damaged and undamaged property from further damage.

- Each situation is unique

- If possible, please take photos before disturbing the area! When Water mitigation company arrives, they will remove or place items up on foam blocks to allow for drying.

Conducted by the Adjuster – he/she will:

- Photograph damaged and surrounding area to include all rooms.

- Measure and document immediate and surrounding areas.

- Conduct an interview with insured regarding the loss

- Photograph all exterior elevations, and all interior rooms.

The Adjuster will discuss the scope of work required for repair with the contractor if involved. Each will submit an estimate to the carrier regarding the scope of work to replace and/or repair damage caused to your structure by this peril.

Note: In addition to the adjuster, a contractor may be involved depending on the damage.

Water Mitigation, Restoration Contractor – Mold Certified

This may be multiple vendors or an individual vendor providing a combination of services.

Water Mitigation Vendor – This is a rapid response to mitigate (minimize, stop and dry) water and/or smoke damage within hours of the loss.

Restoration Contractor Vendor – Removes the damaged materials, rebuilds and/or repairs damage.

Utilizing an insurance experienced vendor can make your task more seamless.

Click to confirm the contractor’s license number

Utilizing an insurance qualified vendor can make your task more seamless.

There are insurance Preferred/Qualified vendors familiar with communicating a written itemized estimate and providing timely service to bringing the insured back to whole.

Since each contractor is looking at the same scope of work, the pricing should also be the same between these vendors, it boils down to who you feel comfortable with completing the task.

- Vendors are independent and do not work directly for the insurance carrier.

- Preferred/Qualified Vendors are a curtesy recommendation by the insurance carrier, you can also refer to the attached list of Qualified vendors near you.

- Review and read all paperwork before signing, the carrier and/or adjuster can provide further insight if needed.

Avoid signing agreements that give the contractor the right to act on your behalf.

- Protect yourself; DO NOT sign any contracts that use “Assignment of Benefits” language without fully understanding what an AOB is. The Florida CFO shares AOB info. Click to read more.

By signing an AOB you surrender your rights to the vendor. They can then receive a check directly from the carrier without performing any work, they can also hold your job hostage demanding more monies above the actual scope of work. This can snowball into a real tangled mess leaving the insured to pay out of pocket.

- What is a “Work Authorization or Service Authorization”: This Is required to begin work, this is a normal business practice so that all parties are in agreement to the terms of service offered. Typically, this agreement gives your vendor permission to provide services immediately, accessing your property to make needed repairs and continue the project to completion following collaboration through the Adjuster or insurance carrier Desk Adjuster. This agreement also confirms the insured’s responsibility for services conducted outside of the coverage amount.

- What is a Direction to Pay: This gives authorization for the carrier to pay the contractor directly following completion of the work. Many carriers stipulate specific requirements before submitting payment to the vendor such as “Certificate of Completion”.

Example: Sample Vendor Contract Wording: In order to start our emergency and restoration service, you must sign the “Service Authorization Form.” This allows mitigation/restoration company to act immediately. We do not know your insurance coverage; therefore, it is impossible for us to know exactly what your insurance will cover. It is important to understand you are financially responsible for our services. Your deductible is payable before we start work. If for any reason insurance coverage cannot be verified at the time of our emergency service, an additional deposit may be required.

Most insurance carriers use qualified preferred vendors; however, they allow the insured to choose vendors outside of the preferred vendors list.

WATER MITIGATION: It is important to dry out your property as soon as possible, this may take 3 to 5 days by an IICRC, WRT Certified Technician.

- There is a science to drying out different types of material, some items will not be salvageable.

- Long term health issues can be diverted by having your property professionally dried out to prevent Mold and Mildew issues that can ultimately affect your respiratory system.

- What is a “Peer Review”: Sometimes the carrier will request a Peer Review; This process is when another knowledgeable company for example: will duplicate the Water Mitigation process through measurements and dry out log sheets (from the original mitigation company) to determine the appropriate equipment was used in the drying process of your property. There is a science to this process!

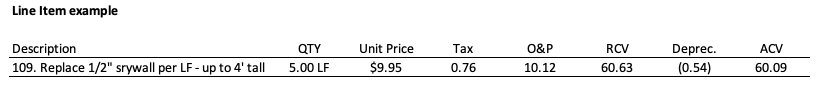

RESTORATION CONTRACTORS: are licensed contractors specializing in their field; in addition to knowing the requirements to conduct the appropriate repair they also understand the insurance format requirements such as documenting “Scope of Work” and “Line Items”.

- They will discuss the “Scope of Work” with the adjuster and provide a “Line Item” estimate to the carrier reflecting the removal and replacement to effectuate the damaged area to pre-loss conditions

- Please understand – NOT EVERY CONTRACTOR IS FAMILIAR WITH THE INSURANCE ENVIRONMENT as it relates to your coverage!

- Estimates recognized in this industry are based on-line items; utilizing linear feet, square feet, and item count and/or squares.

- What is a Line Item? A specific price applied to a unit of measurement. It is similar to Procedure Codes in the US Health Care System.

- Written Estimate: A summary of each effected room in the dwelling and/or Other Structure-Fence, Workshop, Shed, Barn, etc., will be grouped separately; each reflecting a unit of measurement representing labor and materials as it applies to the repair or replacement of a covered item, which is summarized in a “Line Item”; additional Line Items may include service hours and dry-out equipment. Estimates are created from 3rd party software such as Xactimate, Symbility, Simsol, etc…

Any upgrades and improvements will be at an additional cost to the insured and worked out between you and the contractor.

SUPPLEMENT: (A supplement is any work required that was not addressed in the prior estimate.) This will be submitted by your contractor in a line-item format. The restoration company knows how to document and file for a supplement if needed, saving you tremendous time in the process!

Important: If the estimate received from the contractor is higher than the settlement amount, you should notify your carrier before work begins. The carrier must have the opportunity to review and/or view the additional proposed damages.

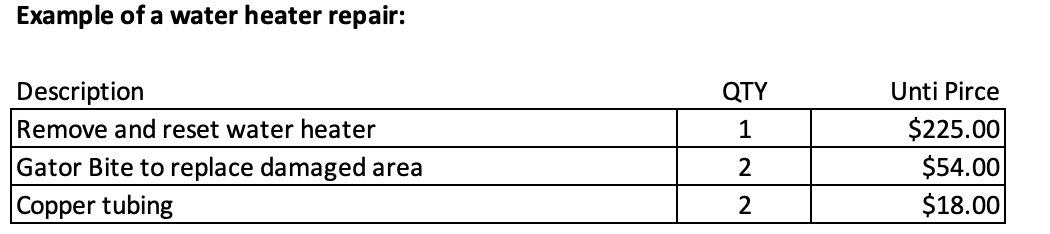

PLUMBER:

- If a plumber is required; have them provide an itemized Invoice of services provided; separate the damaged item on the invoice.

- Retain the faulty part (fitting, pipe, valve, hose, etc. to provide to the adjuster).

- See the example below… Plumber Invoice (Insert jpg of plumbers Invoice)

PLUMBER INVOICE:

The vendor should follow the line-item format for invoicing to submit the plumber’s invoice for reimbursement. It is important to retain receipts of a plumbing repair to provide to the adjuster. The repair invoice plays an important part in a water claim process.

Download our Contents Worksheet here.

Avoid moving items from the place they were damaged unless it is necessary to protect from further damage. If applicable photograph and start making a list of items damaged by this event.

- Content sheets will be provided by the field or desk adjuster, whether you have a mitigation company coming in or not.

- List the items with the required information to the best of your knowledge.

- If there are multiple content items damaged, you will likely be contacted by another vendor that will record your contents inventory.

Note: When restoration begins with contents it is always good to be on site for any questions and directions regarding inventorying of contents.

- Working with Mitigation and/or Restoration company – Inventory and clean damaged contents. Many items can be saved through the cleaning process. This allows your contents coverage to work for you by minimizing your cost of content replacement.

- DO NOT ATTEMPT TO CLEAN ANYTHING ON YOUR OWN if it is fire-related.

- You may be asked how you want your contents sorted. This choice can save you wasted coverage for other items.

- Clean and salvage

- Inventory Only – Do not clean or salvage

- An inventory will be made of clothing and other textile items.

- Drying techniques are conducted to protect Electronics, artwork, appliances, drapes, blinds, furniture, etc. require specific methods of cleaning.

- Timeliness is essential to protecting and cleaning surfaces.

Ozone and deodorizing process are commonly used for removing odors.

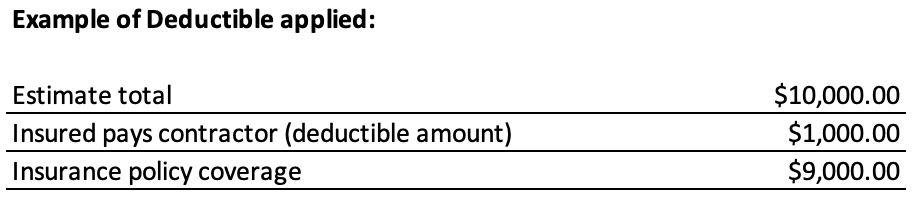

A deductible applies to every policy. Policy language follows individual State Statutes. Most states consider it a Felony if a vendor offers to pay your deductible.

The following information may not apply to this loss.

ALE is additional costs incurred by the policyholder if you are temporarily displaced and required to be out of your home residence. During a catastrophic event other housing options may be limited and not available in your immediate area.

- To qualify – The property must meet specific attributes to render the home unlivable.

- Most carriers utilize a housing location service.

- Their goal is to find a location comparable to your current housing.

- Please understand this is not a vacation plan.

- Depending on each circumstance; You may be relocated to an Extended Stay with a kitchen or rental home if repairs will be ongoing for multiple months.

- Notify your carrier of any special needs/medical needs you may have and/or if pet boarding is required.

- Based on your circumstance it may be necessary for you to stay in a hotel before the carrier can respond; in this case, your receipts can be submitted as incurred

Incurred expenses: is when the policyholder pays out-of-pocket for food and lodging known as the upfront cost to the policyholder and then submits for reimbursement per policy guidelines. These are out-of-pocket costs considered for reimbursement.

Food Expense/Receipts:

- Reimbursement of food

- Save your ITEMIZED receipts from eating out.

- Alcoholic beverages are not permitted.

- Credit Card Statements are not acceptable as they do not show detail.

- Label your recipes, Breakfast, Lunch or Dinner.

- Receipts are only applicable to the area of your home policy address (if you are going on vacation or a business trip you would be eating out anyway). These receipts would not be permitted.

- Expenses for snacks, coffee, breaks, and meals during your workday are not considered additional expenses.

Download our Additional Living Expenses Worksheet here

Important: There is a limit to your ALE coverage, I have seen a few people spend their entire coverage before they were able to get back into their home. Yes, they had to stay with other family members.

Choosing a contractor who understands the insurance process can save you time and frustration, you will be required to sign a “Work Authorization” for them to begin work. Always remember to read before you sign!

Restoration vendors know how to submit accurate line-item pricing, so the insured receives the appropriate coverage for their damages.

- After the contractor and adjuster discuss the scope of work (damaged items and quantity) they each will provide an estimate to the carrier for review of coverage as it relates to the policy you purchased.

- If the estimate received from the contractor is higher than the settlement amount, you should notify your carrier before work begins. The carrier must have the opportunity to review and/or view the additional proposed damages.

- Once your contractor is finished, they will provide a Certificate of Completion to the carrier triggering Recoverable Depreciation based on your specific policy type (See Recoverable Depreciation under “Estimate” section below).

It is important to hire a contractor that understands insurance industry practices such as line items. (A Line Item places a standard in value as it relates to the repair process; for example, replacing Drywall).

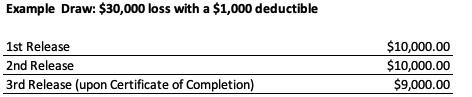

A DRAW may be required by the contractor if the job exceeds $10,000.00 this helps cover initial expenses such as permitting, dry-out, storage cost, restoration, materials, and labor.

- A settlement check or advance may come with all insurable interest names (required by law) printed on the check including your financial institution.

- A Loss draft from the Mortgage company will provide multiple releases during the project based on the levels of completion.

If you have a mortgage and/or an additional insured listed on your policy; your settlement check will be sent with all insureds and additional insured’s name printed as Pay To.

- All payees on a claim check must endorse it prior to deposit.

- You will need to contact your financial institution for instructions on depositing (cashing the check) with other party names listed.

- Accepting/cashing/signing of the check does not release or surrender your rights as the named insured.

Note: A separate check will be issued for each Coverage Category:

Coverage A – Dwelling

Coverage B – Other Structures

Coverage C – Contents

Coverage D – (ALE) Additional Living Expense

Example: ABC Contracting and John & Mary Smith; the contractor may have you (the insured) sign the check so he can deposit funds for his company to do the work. The insurance carrier can provide you more detail and suggestions of this process.

Example: Bentworth Mortgage, Inc and ABC Contracting and John & Mary Smith.

Every financial institution has their own guidelines. You will want to contact your mortgage company for specific instructions on depositing the check and how the funds will be distributed.

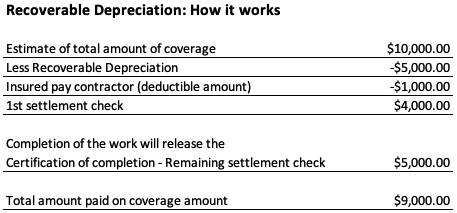

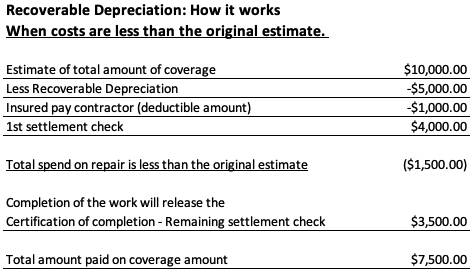

Understanding the estimate and how Recoverable Depreciation is applied. (Recoverable Depreciation may not apply to some policies and/or specific coverages).

- When the adjuster and contractor have an agreed-upon scope of work; each will provide a separate estimate to the desk adjuster for review. The estimates will be reviewed by the carrier examiner and considered with your policy for coverages.

- A line-item estimate will be provided with your Settlement Check from the carrier.

- Every line item describes a cost factor based on “unit of measurement”; Square Feet, Lineal Feet, Square or individual item. This process reflects the costs incurred to bring you back to pre-loss conditions.

- The estimating software used is provided by a 3rd party, who gathers regional labor and material pricing. They operate independently and are not controlled by the insurance carriers.

- A policy will either be an RCV – Replacement Cost Value or ACV – Actual Cash Value.

- If your policy states RCV Recoverable Depreciation will likely apply.

- This means a depreciated amount will be withheld from the original settlement, upon completion of work the depreciated amount is recoverable to the insured.

Example: The contractor submits the “Certificate of Completion” to the carrier, the carrier sends the remaining settlement check. (Insured will receive the remaining “Recoverable Depreciation” check made out to Insured and/or other insurable interests listed on the policy or work agreement.)

If your policy states ACV “Actual Cash Value” – Depreciation will apply and is not recoverable. (You will receive no additional monies.)

Sometimes ACV only applies to specific line items within an estimate.

Request for settlement to carrier/adjuster for additional damage not previously discovered regarding the same loss, that was not addressed on the prior estimate.

- Supplement considerations:

- Newly discovered damage relating to this claim that was not considered in the original estimate.

- Incurred cost is an expense you have to pay-out on before it is considered for coverage such as permits.

(This may not apply to your damage)

Repair invoice plays an important part in a water claim process. If a plumber is required; have them provide an itemized Invoice of services provided.

- Photograph area prior to opening or repairing any ceilings, walls, floors, tile or panels

- Separate the damaged item on the invoice.

Retain the damaged/faulty part/s (fitting, pipe, valve, hose, etc. to provide to the adjuster).