Fire Claim Process

This Fire claim process walks you through all of the steps involved in restoring your home to its pre-fire state. Utilizing my claim experience as an adjuster we have assembled the Claim How Guide providing an expansive overview of the process, this guide will help you navigate your property claim in chronological order with a bulleted format of basic to detail information as it relates to your claim.

This Fire claim process walks you through all of the steps involved in restoring your home to its pre-fire state. Utilizing my claim experience as an adjuster we have assembled the Claim How Guide providing an expansive overview of the process, this guide will help you navigate your property claim in chronological order with a bulleted format of basic to detail information as it relates to your claim.

A Directory of Insurance Qualified Vendors is provided for your convenience. These companies are familiar with communicating responsible pricing. They bring access to a network of skilled labor knowledgeable in working with the insurance carriers’ requirements to bring you back to pre-loss conditions!

Very Important:

Following a fire loss; oftentimes people will show up at your door; if you did not specifically call them, ask if they were sent by your insurance company! The field adjuster or desk adjuster can provide clear direction on this. Be careful of what papers/contracts you are asked to sign.

I have witnessed more than a few times where a vendor will pretend to be helping you resulting in high costs to you the insured, we call this fraud. We provide a list of honest vendors who will truly help you as you work through the fire claim process.

If you have a claim dispute read more about the Mediation and Neutral Evaluation process.

NOTICE: Section 817.234 of Florida Statutes provides in part: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

WHAT TO DO IMMEDIATELY FOLLOWING A FIRE:

- Make sure you and your family are safe and your pets secured.

- Turn the AC/Heat and electric off.

- Turn the gas or fuel off.

- Shut the doors throughout the structure if the fire is limited to a specific area to minimize smoke damage.

- Avoid touching or sitting on items that may have soot, this will minimize cleaning issues later.

- Do not clean anything including, walls, carpets, textiles, clothing or artwork as this may cause stains and odors to permanently set.

- Prepare to remove your prescriptions and food from refrigerator and freezer based on your power options, while observing your safety.

- Avoid handling packages of food for consumption if it has been exposed to fire, heat or water.

- Do not move anything until you have met with the adjuster and fire investigator/s.

- If necessary and if possible; protect the property from further damage.

- Based on the location and/or type of fire you may want to consider turning the water off – this can protect the plumbing pipe from bursting due to high heat exposure.

- Secure jewelry, valuables, and weapons.

Report your fire claim to your insurance carrier; Be sure to provide the best phone number/’s and email address. Share the date of loss and exactly what happened to the best of your knowledge. This will help the carrier to determine potential service vendors needed to effectuate your fire claim.

Although the adjuster has 24 hours to make contact with you from the time they receive the assignment, a fire claim is high priority for many reasons. You will likely receive a call in less time. Please be available at the appointed time, share any current receipts, invoices, or paperwork you have received as the result of your fire claim.

Additional Information:

The following may be directed by the field adjuster or the carrier desk adjuster:

- Contractor – Board-Ups (cover & tarp openings in a structure)

- Contractor – Restoration, to rebuild the structure.

- Mitigation company – Evacuate smoke and/or remove water.

- Mitigation and/or Restoration company – Clean and inventory contents damaged by fire, smoke and water. This allows your contents coverage to work for you by minimizing your cost of content replacement.

Most insurance carriers use qualified vendors allowing you to choose vendors from their list or you may use a qualified Insurance vendor of your choice. Click the Find Qualified Vendors button to find a Qualified Vendor in your area.

Even with a fire claim, a water mitigation vendor will likely be dispatched by the carrier or the insured can contact a local mitigation company. Depending on the level of damage immediate service may be required.

Fire investigators may likely be sent by the carrier and by the state to document cause and origin and are the standard operating procedures when working a fire claim. A restoration contractor may be dispatched by the carrier (known as a preferred vendor) or the insured can contact a local restoration company. Depending on the level of damage immediate service may be required. Although it is rare some carriers require you to use their contractor for all repairs, this would be stated in the policy.

One of the first steps in your fire claim process is to secure your properties damaged areas by boarding or tarping roof, doors, windows, and other openings to protect your property from further damage. This is sometimes provided by a 3rd party.

Important: The carrier must be allowed the “right to inspect” the damage for cause and origin.

The insured (per policy) is required to protect damaged and undamaged property from further damage.

- DO NOT MOVE ANYTHING WITHOUT SPEAKING TO THE ADJUSTER OR FIRE INVESTIGATOR!

- In most cases more damage can be created by touching smoke damaged items.

- A Cause of Loss must be determined to qualify coverage (per policy language).

- If you must move something, please take a photo before disturbing the area! Otherwise please do not move anything!

- Board Up will be conducted to secure and protect your property if necessary.

DO NOT ATTEMPT TO CLEAN ANYTHING ON YOUR OWN

- Your intentions may be good. However, various items require special cleaning techniques. Well-intentioned people have caused greater damage to render an item unsalvageable.

The following may be directed by the field adjuster or the carrier desk adjuster:

- Contractor – Board-Ups (cover & tarp openings in a structure)

- Contractor – Restoration, to rebuild the structure.

- Mitigation company – Evacuate smoke and/or remove water.

- Mitigation and/or Restoration company – Clean and inventory contents damaged by fire, smoke and water. This allows your contents coverage to work for you by minimizing your cost of content replacement.

Most insurance carriers use qualified vendors; however, they allow the insured to choose vendors in addition to the preferred vendor’s list.

During the initial stages of your fire claim, an adjuster will be on-site to inspect and document the damage. This is conducted by Adjuster and Fire Investigator separately and independently, they will:

- Photograph damaged and surrounding area to include all rooms.

- Measure and document immediate and surrounding areas.

- Conduct an interview with insured regarding the loss

The adjuster will discuss with you and the contractor (if involved), the scope of work required for your fire claim. Each will submit an estimate to the carrier regarding the scope of work to replace and/or repair damage caused to your structure by this peril.

Water Mitigation, Restoration Contractor, etc.

This may be multiple vendors or an individual vendor providing a combination of services.

- Water Mitigation Vendor – This is a rapid response to mitigate (minimize, stop and dry) water and/or smoke damage within hours of the loss.

- Restoration Contractor Vendor – Removes the damaged materials, rebuilds and/or repairs damage.

Florida Contractor License Search

Utilizing an insurance qualified vendor can make your task more seamless.

There are insurance Preferred/Qualified vendors familiar with communicating a written itemized estimate and providing timely service to bringing the insured back to whole.

Since each contractor is looking at the same scope of work, the pricing should also be the same between these vendors, it boils down to who you feel comfortable with completing the task.

- The carrier usually does not dictate which vendor to use.

- Vendors are independent and do not work directly for the insurance carrier.

- Preferred/Qualified Vendors are a curtesy recommendation by the insurance carrier, you can also refer to the attached list of Qualified vendors near you.

- Review and read all paperwork before signing, the carrier and/or adjuster can provide further insight if needed.

Avoid signing agreements that give the contractor the right to act on your behalf.

- Protect yourself; DO NOT sign any contracts that use “Assignment of Benefits” By signing an AOB you surrender your rights to the vendor. They can receive a check directly from the carrier without performing any work, they can also hold your job hostage demanding more monies over the actual scope of work. This can snowball into a real tangled mess leaving the insured to pay out of pocket.

- What is a “Work Authorization or Service Authorization”: This Is required to begin work, this is a normal business practice so that all parties are in agreement to the terms of service offered. Typically, this agreement gives your vendor permission to provide services immediately, accessing your property to make needed repairs and continue the project to completion following collaboration through the Adjuster or insurance carrier Desk Adjuster. This agreement also confirms the insured’s responsibility for services conducted outside of the coverage amount.

- What is a “Direction to Pay”: This gives authorization for the carrier to pay the contractor directly following completion of the work. Many carriers stipulate specific requirements before submitting payment to the vendor such as “Certificate of Completion” when the final work is completed.

Example: Sample Contract Wording: To start our emergency and restoration service, you must sign the “Service Authorization Form.” This allows mitigation/restoration company to act immediately. We do not know your insurance coverage; therefore, we can’t know exactly what your insurance will cover. It is important to understand you are financially responsible for our services. Your deductible is payable before we start work. If for any reason insurance coverage cannot be verified at the time of our emergency service, an additional deposit may be required.

WATER MITIGATION: It is important to dry out your property as soon as possible, this may take 3 to 5 days by an IICRC, WRT Certified Technician.

- There is a science to drying out different types of material, some items will not be salvageable.

- Long term health issues can be averted by having your property professionally dried out to prevent Mold and Mildew issues that can ultimately affect your respiratory system or more.

- What is a “Peer Review”: Sometimes the carrier will request a Peer Review; This process is when another knowledgeable company for example: will duplicate the Water Mitigation process through measurements and dry out log sheets (from the original mitigation company) to determine the appropriate equipment was used in the drying process of your property. There is a science to this process!

RESTORATION CONTRACTORS: are (Licensed Contractor) a specialist in their field; in addition to knowing the requirements to conduct the appropriate repair they also understand the insurance format requirements such as documenting, “Scope of Work” and “Line Items”.

- They will discuss the “Scope of Work” with the adjuster and provide a “Line Item” estimate to the carrier reflecting the removal and replacement to effectuate the damaged area to pre-loss conditions

- Please understand – NOT EVERY CONTRACTOR IS FAMILIAR WITH THE INSURANCE ENVIRONMENT as it relates to your coverage!

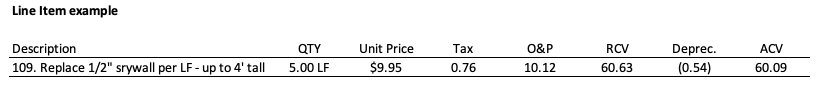

- Estimates recognized in this industry are based on-line items, utilizing linear feet, square feet, and item count and/or squares. These are similar to procedure codes in health insurance.

- What is a Line Item? A specific price applied to a unit of measurement. It is similar to Procedure Codes in the US Health Care System.

- Written Estimate: A summary of each effected room in the dwelling and/or Other Structure-Fence, Workshop, Shed, Barn, etc., will be grouped separately; each reflecting a unit of measurement representing labor and materials as it applies to the repair or replacement of a covered item, which is summarized in a “Line Item”; additional Line Items may include service hours and dry-out equipment. Estimates are created from 3rd party software such as Xactimate, Symbility, Simsol, etc…

Important: The initial estimate can only be written for damages seen (based on your policy contract); if there are additional damages discovered or components required during the repair or replacement process a supplement can be applied for by the vendor/contractor through the Desk Adjuster for additional coverage. Insurance vendors know how this process works.

Below is an excerpt from an Estimate:

Any upgrades and improvements will be at an additional cost to the insured and worked out between you and the contractor.

SUPPLEMENT: The restoration company knows how to document and file for a supplement if needed, saving you tremendous time in the process!

Important: If the estimate received from the contractor is higher than the settlement amount, you should notify your carrier before work begins. The carrier must have the opportunity to review and/or view the additional proposed damages.

See #11 below: CONTRACTOR – WORKING WITH THE RESTORATION CONTRACTOR and preferred vendors:

Download our Content Worksheet here

Fires cause a variety of damage, during your fire claim, avoid moving items from the place they were damaged unless absolutely necessary to protect from further damage. If applicable photograph and start making a list of items damaged by this event.

- Content sheets will be provided by the field or desk adjuster, whether you have a mitigation company coming in or not.

- List the items with the required information to the best of your knowledge.

- If there are multiple content items damaged, you will likely be contacted by another vendor that will record your contents inventory.

Note: When restoration begins with contents it is always good to be on site for any questions and directions regarding inventorying of contents.

Working with Mitigation and/or Restoration company – Inventory and clean damaged contents. Many items can be saved through the cleaning process. This allows your contents coverage to work for you by minimizing your cost of content replacement.

- DO NOT ATTEMPT TO CLEAN ANYTHING ON YOUR OWN if it is fire-related.

- You may be asked how you want your contents sorted. This choice can save you wasted coverage for other items.

- Clean and salvage

- Inventory Only – Do not clean or salvage

- An inventory will be made of clothing and other textile items.

- Drying techniques are conducted to protect Electronics, artwork, appliances, drapes, blinds, furniture, etc. each requires specific methods of cleaning.

- Timeliness is essential to protecting and cleaning surfaces.

Ozone and deodorizing process are commonly used for removing odors.

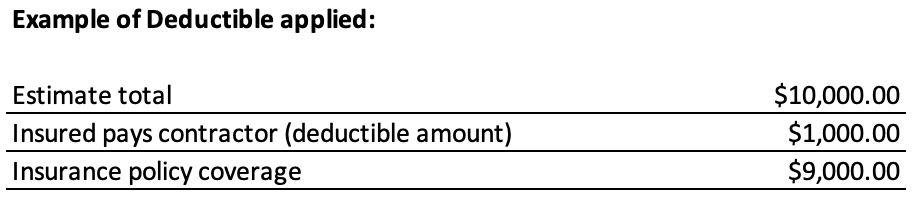

Fire claim deductibles apply to every policy. Policy language follows individual State Statutes. Most states consider it a Felony if a vendor offers to pay your deductible.

The following information may not apply to this loss.

ALE is additional costs incurred by the policyholder if you are temporarily displaced and required to be out of your home residence. During a catastrophic event other housing options may be limited and not available in your immediate area.

- To qualify – The property must meet specific attributes to render the home unlivable.

- Most carriers utilize a housing location service.

- Their goal is to find a location comparable to your current housing.

- Please understand this is not a vacation plan.

- Depending on each circumstance; You may be relocated to an Extended Stay with a kitchen or rental home if repairs will be ongoing for multiple months.

- Notify your carrier of any special needs/medical needs you may have and/or if pet boarding is required.

- Based on your circumstance it may be necessary for you to stay in a hotel before the carrier can respond; in this case, your receipts can be submitted as incurred

Incurred expenses: is when the policyholder pays out-of-pocket for food and lodging known as upfront cost to the policyholder and then submits for reimbursement per policy guidelines. These are out-of-pocket costs considered for reimbursement.

Food Expense/Receipts:

- Reimbursement of food

- Save your ITEMIZED receipts from eating out.

- Alcoholic beverages are not permitted.

- Credit Card Statements are not acceptable as they do not show detail.

- Label your recipes, Breakfast, Lunch or Dinner.

- Receipts are only applicable to the area of your home policy address (if you are going on vacation or a business trip you would be eating out anyway). These receipts would not be permitted.

- Expenses for snacks, coffee, breaks, and meals during your workday are not considered additional expenses.

Download your Additional Living Expenses worksheet.

Important: There is a limit to your ALE coverage, I have seen a few people spend their entire coverage before they were able to get back into their home. Yes, they had to stay with other family members.

Working your Fire Claim Process with qualified/preferred vendors.

Choosing a contractor who understands the insurance process can save you time and frustration, you will be required to sign a “Work Authorization” for them to begin work. Always remember to read before you sign!

Restoration vendors know how to submit accurate line-item pricing, so the insured receives the appropriate coverage for their damages.

- After the contractor and adjuster discuss the scope of work (damaged items and quantity) they each will provide an estimate to the carrier for review of coverage as it relates to the policy you purchased.

- If the estimate received from the contractor is higher than the settlement amount, you should notify your carrier before work begins. The carrier must have the opportunity to review and/or view the additional proposed damages.

- Once your contractor is finished, they will provide a “Certificate of Completion” to the carrier triggering Recoverable Depreciation based on your specific policy type (See Recoverable Depreciation under “Estimate” section below

- It is important to hire a contractor that understands insurance industry practices such as line items. (A Line Item places a standard in value as it relates to the repair process; for example, replacing Drywall).

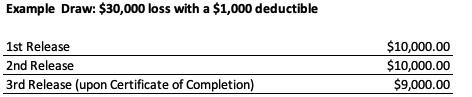

A DRAW may be required by the contractor if the job exceeds $10,000.00 this helps cover initial expenses such as permitting, dry-out, storage cost, restoration, materials, and labor.

- A settlement check or advance may come with all insurable interest names (required by law) printed on the check including your financial institution.

- A Loss draft from the Mortgage company will provide multiple releases during the project based on the levels of completion.

If you have a mortgage and/or an additional insured listed on your policy; your settlement check will be sent with all insureds and additional insureds name printed as Pay To.

- All payees on a claim check must endorse it before deposit.

- You will need to contact your financial institution for instructions on depositing (cashing the check) with other party names listed.

- Accepting/cashing/signing of the check does not release or surrender your rights as the named insured.

Note: A separate check will be issued for each Coverage Category:

Coverage A – Dwelling

Coverage B – Other Structures

Coverage C – Contents

Coverage D – (ALE) Additional Living Expense

Example: ABC Contracting and John & Mary Smith. The contractor may have you (the insured) sign the check so he can deposit funds for his company to do the work. The insurance carrier can provide more detail and suggestions for this process.

Example: Bentworth Mortgage, Inc and ABC Contracting and John & Mary Smith.

Every financial institution has specific guidelines. You will want to contact your mortgage company for specific instructions on depositing the check and how the funds will be distributed.

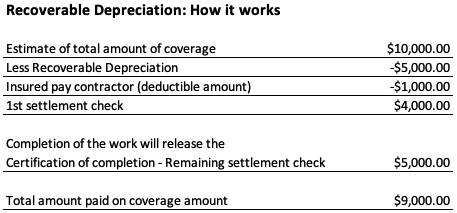

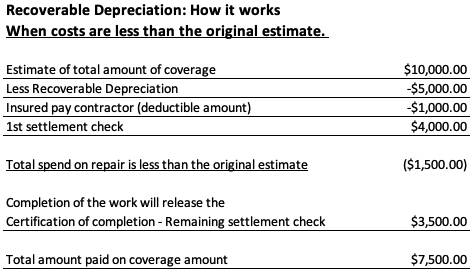

Understanding the estimate and how Recoverable Depreciation is applied. (Recoverable Depreciation may not apply to some policies and/or specific coverages).

- When the adjuster and contractor have an agreed-upon scope of work; each will provide a separate estimate to the desk adjuster for review. The estimates will be reviewed by the carrier examiner and considered with your policy for coverages.

- A line item estimate will be provided with your Settlement Check from the carrier.

- Every line item describes a cost factor based on “unit of measurement”; Square Feet, Lineal Feet, Square or individual item. This process reflects the costs incurred to bring you back to pre-loss conditions.

- The estimating software used is provided by a 3rd party, who gathers regional labor and material pricing. They operate independently and are not controlled by the insurance carriers.

- A policy will either be an RCV – Replacement Cost Value or ACV – Actual Cash Value.

- If your policy states RCV Recoverable Depreciation will likely apply.

- This means a depreciated amount will be withheld from the original settlement, upon completion of work the depreciated amount is recoverable to the insured.

- Example: The contractor submits the “Certificate of Completion” to the carrier, the carrier sends the remaining settlement check. (Insured will receive the remaining “Recoverable Depreciation” check made out to Insured and/or other insurable interests listed on the policy or work agreement.)

- If your policy states ACV “Actual Cash Value” – Depreciation will apply and is not recoverable. (You will receive no additional monies.)

Note: Some items may be ACV only, based on the individual policy.

Special Note: If the rebuild cost is less than the original estimate. The final check will reflect the difference (as the insured is not permitted to profit from a loss).

If your policy states ACV “Actual Cash Value” – Depreciation will apply and is not recoverable. (You will receive no additional monies.)

Sometimes ACV only applies to specific line items within an estimate.

Request for settlement to carrier/adjuster for additional damage not previously discovered regarding the same loss, that was not addressed on the prior estimate.

- Supplement considerations:

- Newly discovered damage relating to this claim that was not considered in the original estimate.

- Incurred cost is an expense you have to pay-out on before it is considered for coverage such as permits.

What is FAILURE TO REPAIR?

The term is specific to the cause; if the insured has received a settlement for repair or replacement and not effectuated the completion for which you received coverage; the carrier can deny any future claims that may be related regarding the failure to repair.

Example: Named insured receives settlement to replace or repair the roof shingles and chooses for whatever reason to NOT replace roof shingles and additional damage occurs, the carrier has no responsibility to place coverage for additional damages that occur, as the insured did not provide due diligence in protecting the property with timely repair or replacement.

Example: Failure to Repair because insured chose $2,500.00 deductible and damages total $2,600.00.